Happy Earth Day ! GenAI and I had a talk today about Earth Day… Over at our sister site on sustainability: SustainZine.com … The Earth Day 2024 posts are divided into: Overview, Part 1, and Part 2 .

There’s a simple quiz on this Earth Day (Plastics). See what my fav GenAI chatbots had to say about getting to zero carbon emissions. What if GenAI were a world leader? Hmmm…

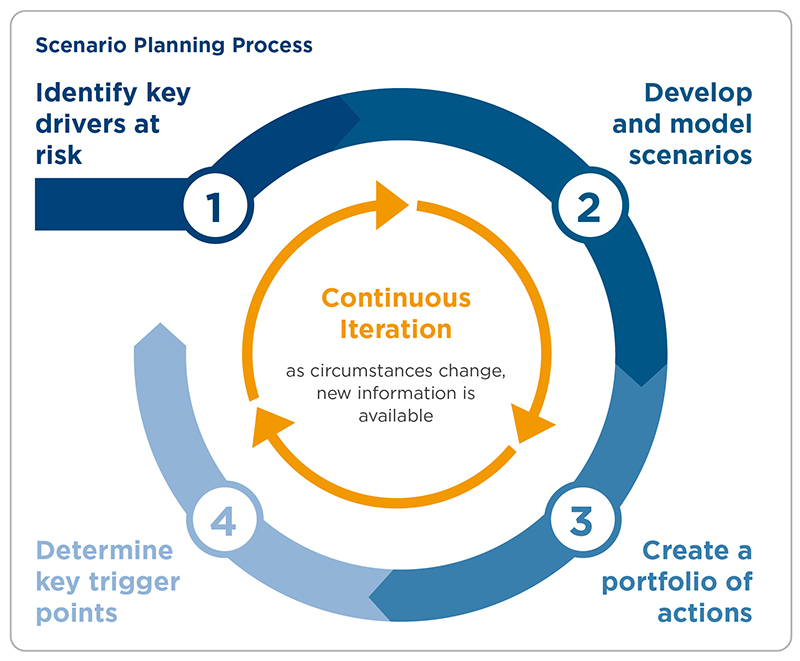

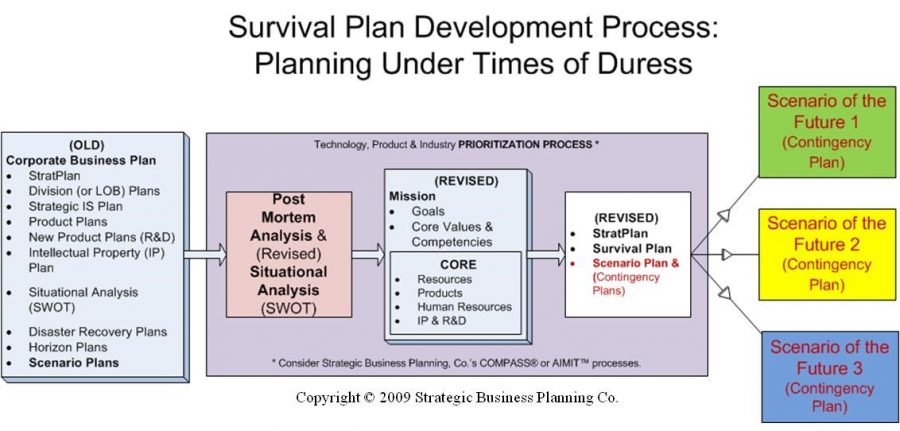

The scenario planning that Earth Day (and long-term sustainability) imply are dramatic. The cost estimates of doing nothing — well, doing more of the same (business as usual) — continue to escalate. There’s probably no industry in any country that doesn’t have to include climate change in their scenario planning.

=> The Earth Day using GenAI is part of our ongoing project to create Regenerative Dynamic (RegenD) Articles that combine Human + Artificial Intelligence (H+AI)… Along these lines, look at the variations of the Sustainability WikiBook which is a dynamic book outline on sustainability topics that links to major Wikipedia pages. the first WikiBook has an introduction that was last updated in 2018. There’s a blog post related to getting GenAI to dynamically produce such a Wikibook with Wikipedia links.

#EarthDay #earthdayeveryday #Sustainability #ReduceReuseRecycle #ScenarioPlans #DelphiPlan #H+AI #RefractiveThinker